Text message scams — also known as SMS phishing or smishing — are one of the most popular scam tactics fraudsters use to steal sensitive personal or financial information. Recognizing scam text messages is essential to prevent financial loss, identity theft, and other privacy breaches. So, read along to learn everything about text message scams and how to stay safe if you receive one.

Table of contents

How do text message scams work?

Scammers are inventive, to say the least. So, when it comes to text messages, they come up with the most random, convincing, and sometimes even outrageous tactics and scenarios for the scam. However, most of them usually fall into these three categories: impersonation, phishing links, and social engineering.

Impersonation — scammers pretend to be a trusted entity (bank, delivery company, government agency, etc.) and try convincing you to take immediate action with urgent text messages.

Phishing links — a scam text will include a link to a legit-looking fake website, where you may be tricked into entering your login credentials, credit card number, and other sensitive, personally identifiable information (PII).

Social engineering — scammers often exploit human error and psychology. By playing with your emotions, such as fear, curiosity, greed, urgency, or kindness, scammers might trick you into giving away sensitive info or money.

What are the most common text message scams?

Since probably any fake text message could be turned into a scam, there are countless types of text scams. But here are the ten most common ones to watch out for:

-

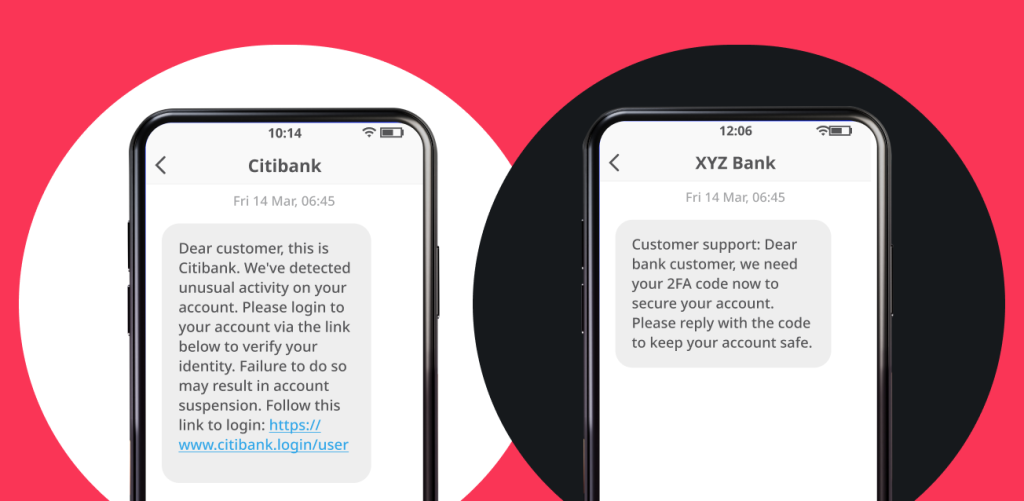

Banking/financial scams

Scammers often pretend to be your bank, credit card company, or other financial institution. They send you a fake text message claiming there’s some suspicious activity in your bank account or that they’re freezing your credit card. Getting a message like that would scare anyone into action, right?

These texts urge you to click a link or call a provided number — if you follow through, that’s when phishing attempts to steal your sensitive information happen.

-

Delivery scams

Approximately 20% of all retail purchases happen online (and it’s expected to grow). Naturally, people who shop online get many text messages about their deliveries, some of which are missed or delayed delivery notifications. And scammers love these, as they’re quite an easy way to steal personal information.

They might send you these delivery notification scam texts pretending to be a post office, UPS, FedEx, or any other delivery company. They claim some issue with your delivery, asking you to click on a link to “solve it.” And, since you’re probably waiting for some package to arrive, you might click on that link to a fake site and input whatever information they’re asking for.

-

Prize/gift scams

Are you entering many online contests? Some of them could be scams. And even if you haven’t entered any, receiving a text message saying you’ve won a cash prize, a new laptop, or a paid holiday to some tropical resort could really pique your interest — who doesn’t love a freebie?

Scammers use this tactic a lot — they send a text informing you you’ve won in some contest or lottery and ask you to click on a link to claim your prize. After clicking on the link, you might be asked to provide your personal information and bank account details or even pay some “fee” to receive it.

-

Account verification scams

Another popular tactic scammers use to gain access to your accounts and information is pretending to be trusted services — such as Apple, PayPal, Google, etc. — and sending fake account verification messages.

The message usually claims suspicious activity, security issues, or the account’s suspension, requesting you to verify your account. The scam text will ask you to send back a 2FA (two-factor authentication) code or follow a link that will take you to a fake website where you will be asked for your login credentials.

-

Wrong number scams

One of the more elaborate scams that require a lot of human interaction is the so-called “wrong number” text scam. It starts with a text message from a stranger, pretending to have sent it to the wrong number.

The message could be anything from a simple “Hey” to a reminder about a business deal that’s supposed to close tomorrow afternoon. The goal is to engage you in a conversation, build trust or intrigue you, and eventually move on to the scam — asking for sensitive information or money, offering to invest in something, etc.

-

Personal loan or debt relief scams

In these text messages, scammers pretend to offer loan services or debt reduction/forgiveness. These scams will usually promise too-good-to-be-true terms, but if you’re in a desperate financial position, you might fall victim to such enticing offers.

In order to process your “application,” the scammers will ask for your PII, upfront payments, or service fees. This can lead to identity theft and financial loss.

-

Government agency scams

Nobody really wants to deal with government agencies like the IRS or the Social Security Administration. People get especially nervous when it involves unpaid taxes, problems with benefits, or similar issues. And that’s what scammers take advantage of.

These fake text messages threaten you with fines and legal action, creating a sense of urgency. The message usually includes a link where you can “resolve” the issue. However, the link leads to a phishing attack.

-

Refund scams

On the contrary to owing someone money, getting a refund always feels great. And scammers often exploit this in the form of text scams. They impersonate a business, a government agency, or a utility service, claiming that you’re owed a refund from them.

To get the fake refund, you have to click the included link, which will take you to a malicious site where — want to guess? — you’ll be phished for your personal and banking information.

-

Emergency texts

Tale (or scam) as old as time — you get a message from an unknown number claiming that your friend or a family member is hurt, in danger, or in some legal trouble. The good person that you are, you panic. Fear and concern take over. The scammer tells you this is very urgent, you’re the only one who can help your loved one, and asks you for money. They might even ask you to keep it a secret. You comply.

Emergency text scams are the prime example of how human emotions can be manipulated.

-

Texts from your own number

Probably the strangest of all text scams are the messages that appear to come from your own number. Scammers are spoofing users’ phone numbers and sending various messages, hoping to get your attention.

Usually, these text messages also include a fictitious link, and clicking on it might expose you to all the usual threats, such as phishing, malware, sharing of personal information, etc.

What to do if you receive a scam text

Scam texts will always be unsolicited (as in, not a response to your text), might have grammar mistakes, and usually will include dodgy links. If you suspect you received a scam text message, here’s what you should do:

- Do not respond to the message or click on any links — interacting with the sender or clicking on any links may lead to phishing or malware attacks. If you fear that some of the text messages might be legitimate and you want to double-check — instead of clicking on the link, go to the official website through a web browser, log in to your account, and check notifications. You can also call the company’s official number and talk to a representative;

- Delete the message to avoid accidental interaction — deleting the message will prevent you from accidentally opening the message, clicking on a link, or calling the scammer;

- Block the sender’s number to prevent further contact — in addition to deleting the message, you should block the number to stop any future scam messages;

- Report the scam to your mobile carrier or relevant authority — with some carriers, you can report the scam by forwarding the message to a dedicated number. You could also report the scam to a consumer protection agency like FTC (Federal Trade Commission).

How to protect yourself from texting scams

Here’s what you can do to protect yourself from texting scams:

- Enable spam filters on your phone to block unwanted messages — the majority of phones have built-in features that filter out spam and block recognized scam numbers;

- Regularly update your contact preferences to control who can reach you — modify the settings on websites, apps, and services to restrict who can access your phone number;

- Use a virtual phone number — using Surfshark’s alternative number for online services or signups can reduce the risk of your primary number being exposed to scammers;

- Remove your phone number from data broker lists — you can remove your information, including phone number, from data broker lists with services like Incogni. FYI, Incogni comes with a Surfshark One+ subscription — for a small monthly fee, you can protect not only your phone number but your whole presence online.

Note: You can also read my article, which has step-by-step instructions and a more in-depth explanation of how to block spam texts on Android specifically.

The bottom line: scammers are smart, but you can outsmart them

Scammers use text messages as an easy way to trick people out of their personal information and money. While some of their text may look very convincing, there are usually clear signs almost screaming, “SCAM!” Having read this article, you now have all the ammo to outwit the fraudsters — stay vigilant, recognize their scammy tactics, and don’t fall victim to another text scam ever again.

FAQ

What happens if you reply to a scam text?

When you reply to a scam text, scammers may try to engage you in further conversation and convince you to share sensitive information, give them money, etc. You also confirm that your phone number is active, making you a target for future scams (scammers tend to share/sell this kind of information).

Can a scammer get into your phone by text message?

Although a scammer cannot directly access your phone through a text message, clicking on a link in the text might install malware on your device and compromise it.

Can you get phished by opening a text?

Just opening a text is generally safe. However, if you click on links or engage in conversation with the sender, you could fall victim to a phishing attack.