Carding is a type of financial fraud where criminals use stolen credit card information to make unauthorized purchases. It’s a popular choice among fraudsters because it’s easy to pull off and can bring in big bucks. In fact, it accounts for a huge chunk of the $914,349,424 lost to credit card fraud.

With carding becoming a bigger threat than ever, it’s wise to learn more about it and take protective measures. Read along to find out how it works, red flags to watch for, and tips for keeping yourself safe. Let’s start with a clearer definition of carding.

What is carding?

Carding is a form of financial fraud in which your stolen credit card information is used to make purchases without your consent. These purchases often take the form of gift cards, top-up prepaid cards, or goods that can be resold for cash. Originally referred solely to credit cards, the term “carding” has since expanded to include the fraudulent use of debit cards.

How carding works

Carding can be over within minutes, with criminals — known as carders — taking off with stolen funds before you even notice.

It usually starts with carders getting hold of your credit card details illegally and quickly verifying whether the card is active. If it is, they make purchases. If your card remains active afterward, your information could be sold on the dark web or repurposed for other financial crimes, like various forms of identity theft.

Let’s take a closer look at how carding works.

Obtaining credit card details

What makes carding so pervasive is that there are plenty of ways to steal credit card information, both online and offline. Common methods include:

- Data breaches: carders access databases of companies, websites, and even banks to steal credit card information;

- Phishing scams: malicious actors send bogus texts or emails impersonating legitimate services to trick you into revealing sensitive information;

- Bot attacks: criminals exploit automated software to guess credit card numbers through credential stuffing;

- Hacking: hackers use malware to infiltrate your phone, computer, or even emails to steal credit card details;

- Skimming: carders install devices on ATMs (Automated Teller Machines) and POS (Point of Sale) terminals to capture card information;

- RFID (Radio Frequency Identification) skimming: attackers wirelessly scan your contactless cards using hidden RFID readers, though confirmed cases of such attacks are extremely limited;

- Shoulder surfing: bad actors observe as you enter your credit card information;

- Dark web: cybercriminals buy and trade stolen card details on dark web marketplaces.

Verifying validity

Since credit cards are usually canceled quickly after being lost, a big part of carding involves testing stolen card information to see if it still works. Carders typically use automated tools to check the balance or make small purchases that won’t draw much attention before attempting larger transactions.

Cashing in

If your card is active, carders can use the stolen information to make purchases, usually online. Common buys include:

- Gift cards: these don’t require personal information, making them tough to trace;

- Prepaid top-up cards: they allow quick fund-loading without personal details, essentially turning your stolen credit card info into usable money;

- Electronics: their high resale value and constant demand make these items easy for carders to flip for quick cash.

Carders may also create physical cards using the stolen details to carry out “card present” fraud, using them for in-store purchases.

Whether online or offline, carders cover their tracks by using fake identities, donning disguises, or encrypting communications. For goods that need shipping, they often use drop addresses — places not tied to them — to dodge law enforcement.

There’s also a high chance your stolen credit card info might end up on carding forums on the dark web, where bad actors sell and swap data and collaborate to level up their schemes.

How to know if your card details were stolen

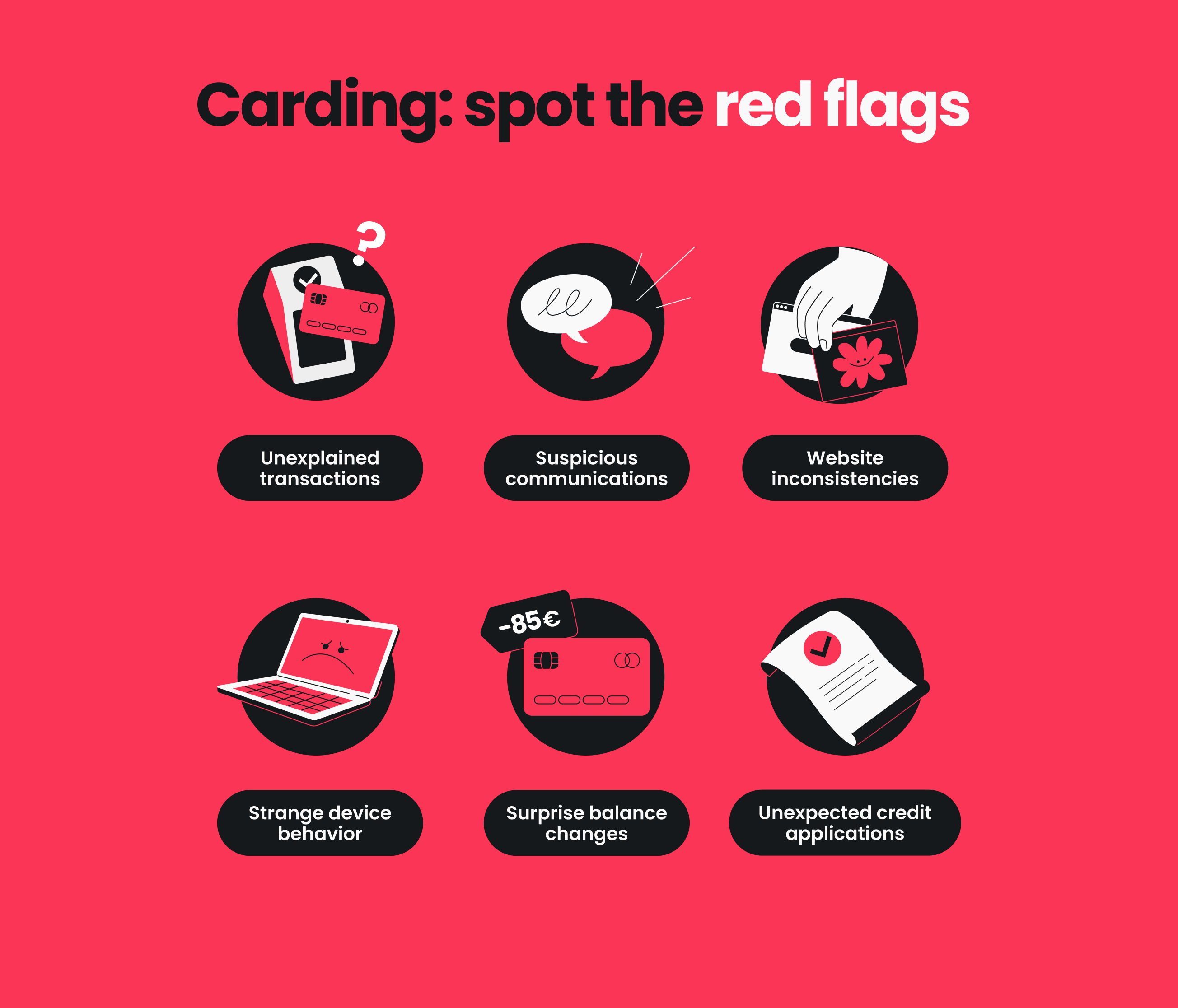

Carding can be difficult to catch. Sometimes, it takes victims months, or even years, to notice someone’s been using their credit card details without permission. So, how can you tell if you’re a target for carding? Well, here are some warning signs that might give it away:

Unrecognized financial activity

Unfamiliar charges or withdrawals on your bank or credit card statements can be a strong indication that someone has accessed your card information. Don’t dismiss small, seemingly insignificant charges either — they’re often used to test if your card is active before they go for larger purchases.

Suspicious communications

Random phone calls, texts, or emails asking for your private information or confirming transactions you didn’t make are usually just ploys to get you to spill revealing details. Scammers often impersonate legitimate companies such as banks, financial institutions, or retailers to win your trust and trick you into sharing compromising personal information.

Website irregularities

When browsing, shopping, or banking online, be wary if you’re redirected to websites that feel off or have slightly altered URLs. Things like suspicious design flaws, spelling mistakes, and broken links should set off your alarm bells. These could be fraudulent sites made to mimic the real deal to steal your card details or login credentials.

Unusual device performance

Sudden changes in your device are major red flags. These changes could mean that your device has been infected by malware that tracks your keystrokes, enables remote tampering, or steals your credit card information for carding. Here are some warning signs to watch out for:

- Noticeable sluggish performance;

- Frequent crashes;

- Sudden battery drain;

- Unfamiliar applications;

- Changes in settings;

- Strange pop-ups.

Unexpected balance changes

Most credit card providers issue alerts once your balance hits a certain level or if you’ve maxed out your card. These notifications are meant to help you manage your spending. However, if you receive such notifications without making any big purchases, it could suggest that someone else is using your card details.

Unauthorized credit applications

If new credit cards, lines of credit, or other financial services have been opened in your name without your say-so, it’s a strong indication of identity theft. It means someone is misusing your personal info. If this happens, there’s a good chance your credit card details are also compromised, putting you at risk of carding.

How to protect yourself against carding

When it comes to carding, prevention is key. Let’s run through the steps you can take to keep yourself safe.

Monitor your financial accounts

Regularly check your credit card transactions, bank statements, and online account activity for anomalies like unfamiliar charges or repeated small purchases. Look out for recurring transaction errors with specific merchants, too. Make sure to flag and review anything that doesn’t fit your usual spending habits.

Aim to check your accounts as often as possible, ideally at least once a week. However, if that feels overwhelming, even a monthly audit is better than none. By staying vigilant, you can help catch carding attempts early and prevent bigger losses down the line.

Use secure payment methods online

Many banks and credit card companies now offer virtual credit card numbers for online payments, keeping your actual card details safe. Even if carders get ahold of your info, they will only see temporary data that becomes obsolete quickly.

You can check out privacy-focused payment methods like PayPal, Apple Pay, Google Pay, or even prepaid cards. These options use tokens or one-time codes instead of your actual card numbers, adding an extra layer of protection. Many of them also offer 2FA (Two-factor Authentication), requiring a secondary form of verification to minimize unauthorized use.

Create strong, unique passwords

Using strong, unique passwords for all your accounts is one of the best defenses against carding and other types of online scams.

Here are some quick tips for creating strong passwords:

- Aim for at least 12-16 characters;

- Include a mix of upper and lowercase letters, numbers, and special characters;

- Don’t use easily guessable details like birthdays or common words such as “password”;

- Avoid simple sequences or patterns like “abc123” or “123456”;

- Skip obvious replacements like “b@nk1ng”;

- Regularly change your passwords.

Use a VPN

A VPN (Virtual Private Network) like Surfshark encrypts your internet connection, making it difficult for malicious actors to intercept your information, including credit card details, while you browse or shop online. Even if intercepted, all they’ll see are indecipherable characters. This is particularly crucial when you’re on unsecured networks like hotel Wi-Fi.

Some carders also track your IP (Internet Protocol) address to snag your credit card info. For instance, knowing your whereabouts can help them launch phishing attacks, dumpster dive for your statements, or even swipe your physical credit card from your mailbox. By masking your IP address with a VPN, you significantly cut down the risk of targeted carding attacks.

Leverage Alternative ID

Surfshark’s Alternative ID lets you create email addresses with a customizable online persona to protect your real identity. The email addresses help minimize spam and phishing attempts, which are often used to obtain credit card info. You can use the alternate email to browse, create accounts, and more, and simply generate a new one when the spam gets out of hand.

Meanwhile, the online persona keeps your real identity under wraps, making it hard for carders to tie stolen credit card information to you in a targeted attack. Also, having a persona cuts down on the personal information you share online, reducing the risk of it being misused in carding schemes.

Set up alerts

Most banks and credit card providers offer alert features for things like card charges, overseas purchases, and account setting changes. Be sure to enable these alerts to catch any carding attempts early.

In addition to transaction alerts, consider using Surfshark Alert. It scans the web for leaks involving your email and personal information, sending real-time alerts if it finds anything suspicious. If you receive an alert, you’ll know your data has been compromised, allowing you to quickly take steps to minimize damage, like freezing your credit cards.

What to do if you fall victim to carding

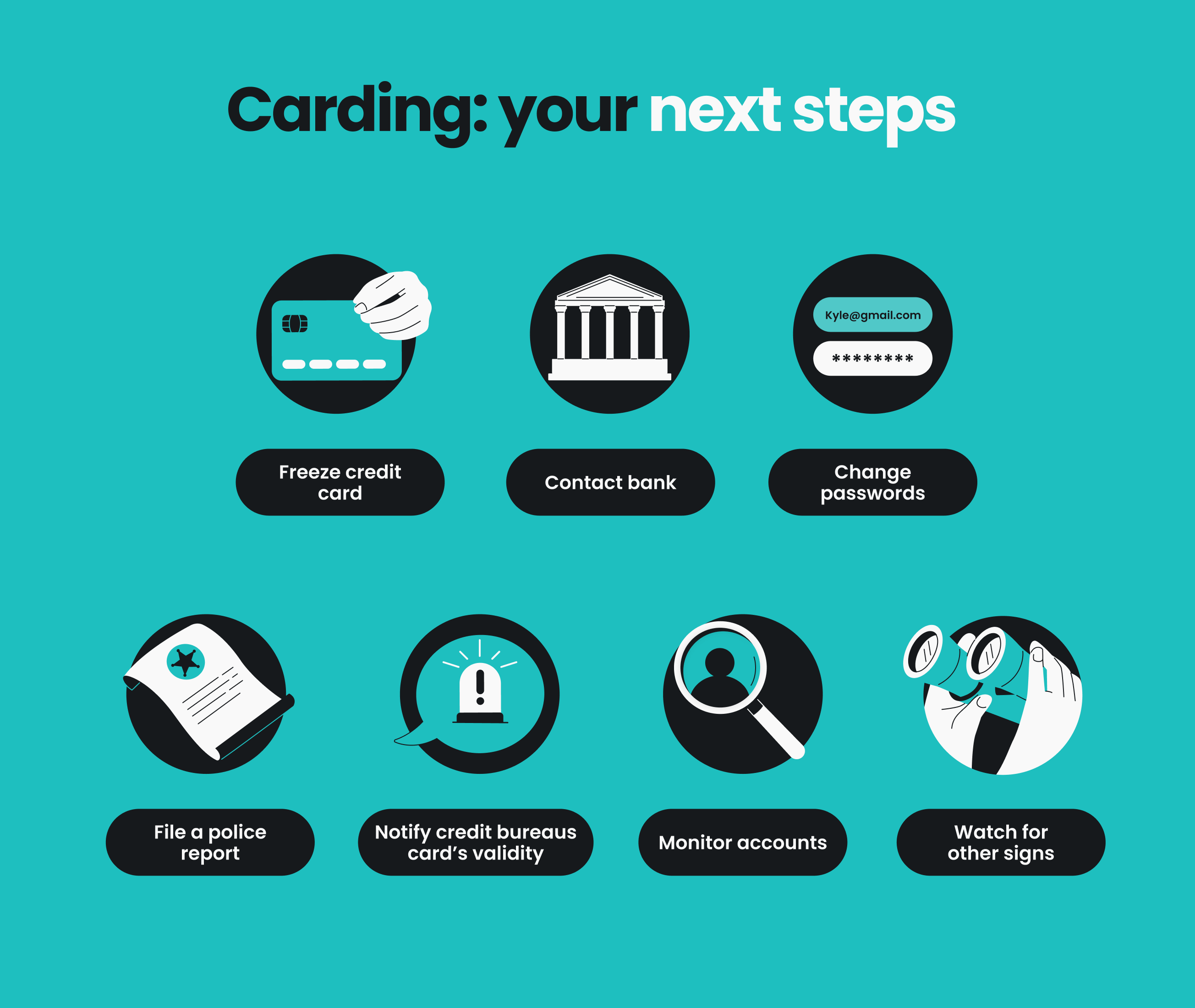

If you think you might be a carding victim, here are some essential steps to take right away:

- Freeze: put a hold on your credit card and any linked cards to prevent further misuse;

- Contact: file a report with your banks and credit card providers to potentially reverse the charges or initiate a chargeback;

- Update: change passwords for any accounts linked to your card information immediately;

- Report: file a report with your local authorities and other relevant agencies, like the FTC (Federal Trade Commission) if you’re in the US;

- File: contact credit bureaus in your area to place a fraud alert on your credit;

- Monitor: keep a close eye on your financial accounts and credit card for any further suspicious activity;

- Check: look for signs of identity theft, as the carder could have also gotten hold of your other sensitive information.

Stay sharp, prevent carding

Knowing how to tell if someone is using your credit card information without permission is vital to limit fallout. Watch out for signs like unexplained purchases, sketchy texts or emails, and sudden drops in your balance.

Still, the best defense against carding is to take proactive measures. Monitor your financial accounts closely, stick to secure payment methods, and create strong, unique passwords. You might also consider adding Surfshark One — which offers three-pronged protection against carding with its VPN, Alternative ID, and Alert features — to your toolkit.

FAQ

What is carding, and is it illegal?

Carding is a type of financial fraud in which carders use stolen credit card information to make unauthorized purchases. It’s illegal, and participating in carding, whether buying or selling stolen card details, can land you in jail or result in severe penalties in most countries.

How do carders get caught?

Carders can get caught when law enforcement tracks their online activities and monitors suspicious transactions. They usually use techniques like tracing IP addresses, identifying patterns in fraud, going undercover, and running sting operations in dark web markets. Businesses and consumers can also pitch in by reporting fraud promptly.

Can you go to jail for carding?

Yes, you can go to jail for carding. Carding is a serious financial crime, and those caught can face criminal charges. Penalties may vary by state and country, but they may include imprisonment for up to 20 years, hefty fines, and potential restitution.

What is the process of carding?

The carding process typically has three main stages. First, carders get your credit card information through illegal means like hacking, phishing, or buying it on the dark web. Next, they test the card with small purchases to check if it works. Once confirmed, they make larger purchases — think high-ticket items, gift cards, or prepaid cards. Some carders may also sell the acquired info on the dark web for profit.