Identity thieves always seem to be working their black magic to put our online data at risk.

While we muggles might not be able to conjure any protective charms while surfing the web, we can luckily take practical, proactive steps to safeguard our identities.

Is identity theft protection worth it, and how can it defend you from the internet’s frauds, cheats, and hackers? Keep reading to discover just how important identity theft protection services are.

Table of contents

How to know if you need identity theft protection

Do you need identity theft protection?

Defending yourself from cybercriminals is a good idea for anyone. Reports say 33% of Americans have already faced some form of identity theft, so you never really know how safe you are.

That said, your chances of exposure depend on your lifestyle and online habits. People who fit the following criteria are at greater risk of identity theft, making them prime candidates for a protection service.

You have had previous incidents of identity theft

If you’ve been a victim of identity theft before, you’re at a higher risk of it happening again. Identity thieves often attempt to exploit a victim’s information multiple times, so having identity theft protection can help you detect and prevent any future attempts.

You regularly use online financial services

People who frequently use online banking, credit monitoring, or other financial services are more vulnerable to identity theft. The more sensitive information you have on the web, the better chances cybercriminals have of stealing it. That’s why it’s a good idea to turn to identity theft protection to defend your financial accounts and get alerts about any suspicious activity.

You frequently share personal information online

We all know someone who loves to overshare. Unfortunately, the more personally identifiable information you share online — whether through social media accounts, shopping sites, or online forms — the greater your risk of identity theft. Identity protection services can help you keep your information safe and let you know of any potential dangers.

You use public Wi-Fi

Public Wi-Fi networks are usually unsecured and are notoriously easy targets for identity thieves. Anyone who routinely uses public Wi-Fi, from folks who lounge in their local café all day to jetsetting businesspeople who are always on the go, would benefit from identity theft protection.

You have a large social media presence

Looking to be the next Kylie Jenner? Figures with many followers or connections on social media platforms have increased exposure to identity theft risk. Aspiring influencers, beware — the wider your network, the easier it is for hackers to access your personal information through phishing scams and other attacks.

What do identity theft protection services do?

Identity theft protection services defend you against cybercriminals by monitoring your personal information, alerting you to suspicious activity, and providing support if your identity ever gets compromised.

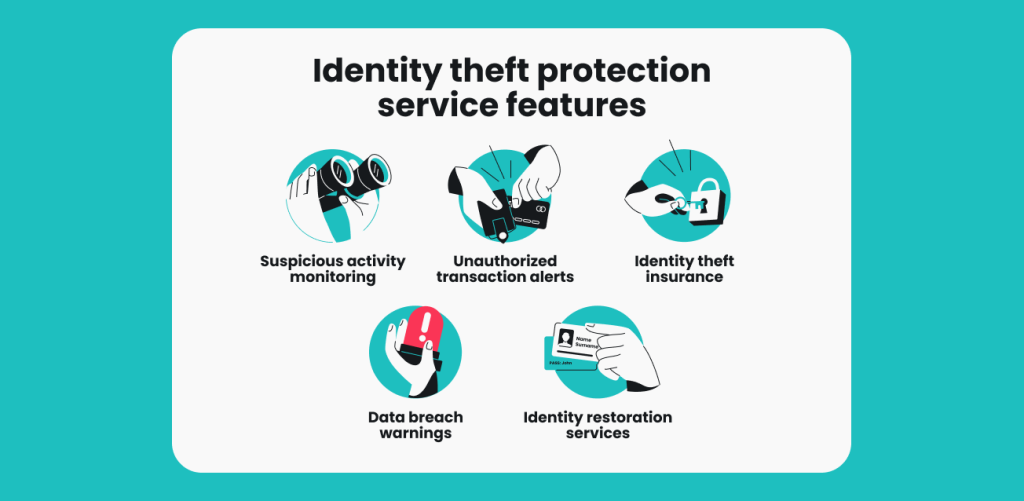

From credit monitoring to identity theft insurance, here’s a breakdown of the key features and benefits these services typically offer:

Suspicious activity monitoring

Identity protection services scan for your information across various platforms, including bank accounts, credit reports, and social media accounts. They look for suspicious activity, like unusual credit or debit card transactions or attempts to open online accounts in your name.

Some protection services offer more specialized bundles or family plans, so getting tailored assistance like child identity theft coverage or dark web monitoring is also possible.

Unauthorized transaction alerts

You’ll receive real-time alerts if your service detects any unauthorized activity, such as suspicious withdrawals from your bank account or changes to your credit report. These early warning systems help potential victims take immediate action — like contacting the right financial institutions — to prevent further damage.

Many solutions also offer support in the form of credit monitoring services or your very own password manager to ensure your data and funds stay right where they need to be.

Identity theft insurance

Many identity theft protection plans offer insurance that can cover the costs associated with identity theft recovery, including legal fees, lost wages, and the cost of restoring your credit scores. ID theft insurance serves as a valuable safety net in the event of medical identity theft, credit card fraud, or other kinds of theft.

Data breach warnings

With data breaches and leaks becoming increasingly common, identity theft protection services provide alerts if your personal information is compromised online. This lets you swiftly take corrective measures, like changing your passwords, placing a credit freeze on your accounts, and obtaining the relevant bank statements and credit reports to minimize any damage that gets done.

Identity restoration services

Recovery services can be an absolute lifesaver for victims of stolen identities. These services usually include filing identity theft reports for credit card issuers, contacting your credit reporting agency, and removing fraudulent information from your credit file.

What are the pros and cons of identity theft protection?

Here’s a look at the benefits and potential drawbacks of using identity theft protection services:

Pros | Cons |

|---|---|

Early fraud detection | Service costs |

Peace of mind | Variable quality |

Recovery support | Limited effectiveness |

Wide-ranging defense | Potential overlap with existing services |

Pros of identity theft protection

- Early fraud detection: protection services can catch fraudulent activity early on, often before you’re even aware of it. This early detection can prevent further damage to your credit and personal information;

- Peace of mind: knowing that your personal information is being monitored can provide significant peace of mind, especially at a time when data breaches and identity theft are increasingly common;

- Recovery support: if your identity is stolen, having the backing of a protection service means you’ll have access to professional resources to help you navigate the recovery process. Features like lost wallet assistance can save you heaps of time, stress, and money;

- Wide-ranging defense: theft protection can cover everything from bank accounts, court records, Social Security Numbers, and more. Broader protection lowers the chances of an identity theft incident slipping through the cracks.

Cons of identity theft protection

- Service costs: these protection services typically come with a monthly or annual fee. While some might see this as an unnecessary expense, just a few dollars can go a long way toward keeping you safe online;

- Variable quality: not all identity theft protection services are equal. Some offer more comprehensive coverage, so it’s important to do your research before choosing a provider;

- Limited effectiveness: while these services can help detect and respond to identity theft, they can’t prevent all instances. It’s vital not to lull yourself into a false sense of security. Even with protection, it’s still possible for an identity thief to gain access to your information;

- Potential overlap with existing services: some features offered by protection services, like a password manager and credit report monitoring, might be available — maybe even free of charge — from other sources already at your disposal, like your credit card company or virtual private network (VPN) provider.

Note: even with identity theft protection, staying cautious and practicing common sense online is still important. Use complex passwords, regularly check your financial accounts, and avoid browsing the dark web.

How can Surfshark Alternative ID help you?

If you’re looking for a proactive way to protect yourself from identity theft, Surfshark Alternative ID offers a unique solution.

Unlike traditional identity theft protection services that focus on damage control, Surfshark Alternative ID aims to prevent identity theft from happening in the first place by reducing the chances of your personal information getting exposed online.

How does Surfshark Alternative ID work?

It generates a new online persona for you to use instead of your actual information. This means that in the event of a breach, your regular identity remains protected. Alternative ID minimizes the risk of identity theft and unauthorized access to your personal info, essentially nipping the problem in the bud.

Alternative ID includes an alternative email service that forwards messages to your primary inbox while keeping your regular email address hidden. For phone privacy, you can also get an alternative number as a paid add-on to Alternative ID. Both these tools let you register for accounts and services without exposing your real contact information.

Identity theft protection’s true value

Is identity theft protection worth it?

You bet.

For most internet users, identity theft remains a creeping threat that can strike when you least suspect it. Gain added security — and peace of mind — with an innovative tool like Surfshark Alternative ID, designed to help you evade cyberattacks more effectively.

FAQ

What is the best defense against identity theft?

The best defense against identity theft is a combination of a reliable identity theft protection service like Surfshark Alternative ID and staying cautious and vigilant online. Good ideas for staying safe include using unique passwords, enabling two-factor authentication (2FA), and regularly monitoring credit reports.

Should I worry about identity theft?

Yes, identity theft is a genuine concern for many internet users. With increasing cyberthreats, data breaches, and leaks, it’s important to take proactive steps to protect your personal information and mitigate the risk of theft.

Will changing my name stop identity theft?

No, legally changing your name won’t fully protect you against identity theft. However, using a service like Surfshark Alternative ID to mask your online identity with a new name, date of birth, and address can effectively keep your actual data out of the hands of identity thieves.

Are identity protection services worth it?

Identity theft protection services are worth it for anyone looking to give their personal data an added layer of security on the web. With features ranging from free credit monitoring, tax fraud prevention, and protection against credit card theft, these services provide greater safety to most internet users.

How does identity theft protection work?

Services offering identity theft protection track your personal information across various online platforms and alert you to suspicious activity. Many check documents like your credit card bills to see if your accounts or documents — even your driver’s license — have been compromised. They can also have features like identity monitoring or dark web scanning for advanced security.

Do I need an identity theft protection plan?

Yes, an identity theft protection plan can be a valuable safeguard against cybercrime, especially if you’re concerned about data breaches, fraud, or unauthorized use of your personal information. These plans usually provide monitoring, alerts, and recovery assistance, offering you greater security online.

How likely am I to get my identity stolen?

The likelihood of identity theft depends on various factors, including how well you protect your personal data and whether your information is exposed in data breaches or leaks. With cybercrime on the rise, it’s important to stay vigilant and take proactive steps to secure your identity.

Is identity protection worth the cost?

For many, identity protection services are worth the cost for the extra layer of security they provide online. They can help detect suspicious activity early on and offer recovery support if your identity ever gets compromised, potentially saving you time, stress, and money.