Criminals can use your SSN (Social Security number) to commit identity theft and open credit cards, create bank accounts, and claim tax refunds in your name. They can also get a job, rent a home, or apply for a loan under a false identity.

Committing fraud using only an SSN is rather difficult, but you’ll usually find someone’s SSN on documents with other PII (Personally Identifiable Information), and that is dangerous.

Table of contents

7 ways thieves can exploit your SSN

Because an SSN is unique to every individual, it is a very useful identification tool. But since it’s difficult to use on its own, criminals get quite crafty when it comes to using your Social Security number for fraudulent purposes.

In essence, all types of SSN-related identity thefts use the number plus your additional information to bypass identification procedures in social and financial institutions. So, to people wondering what someone can do with their SSN, the following is just scratching the surface.

- Financial identity theft

An identity thief can use your SSN together with your PII to open new bank accounts or access existing ones, take out credit cards, and apply for loans all in your name. Often, you wouldn’t even know it was happening until you’d start receiving calls or emails from unknown creditors or get turned down when applying for a mortgage.

Financial identity theft is the most common type of fraud that uses SSNs. It affects around 5% of Americans annually, resulting in losses topping $1.1B over the last decade.

- Social Security benefits fraud

This type of fraud aims at using an SSN to steal someone’s Social Security benefits or file for unemployment in their name. Just like with financial identity theft, you may not know someone else is profiting from you until you apply for social benefits yourself and get denied.

For example, the COVID-19 stimulus fraud, when identity thieves steal others’ stimulus payments, falls under the category of social benefits fraud.

- Tax identity theft

Tax identity theft is a lot like Social Security benefits fraud. The only difference is that the identity thief uses your SSN and PII to file tax refunds instead of benefits in your name.

Tax identity theft is also known as Stolen Identity Refund Fraud (SIRF)., While not as common as financial identity theft, it still costs people millions of dollars every year.

- Medical identity theft

Using your SSN and personal information, an identity thief could avoid paying for medical care or emergencies themselves. This can have negative effects on your insurance. If you become a victim of medical identity theft, you may begin receiving unfamiliar bills and notices and be denied medical coverage.

- Criminal identity theft

Criminal identity theft is when someone uses your SSN and PII to avoid criminal responsibility. This can allow the identity thief to get away scot-free from a speeding ticket or, in some cases, even arrest. Instead, this criminal’s responsibility will fall on your shoulders, which can cause problems later in life when seeking employment or dealing with other legal issues.

- Utility fraud

Fraudsters can use your information and Social Security number to open or upgrade utility service agreements. This can include water, gas, electricity, phone, internet, cable, or other services. Like the rest of the SSN identity theft types, you may not know someone’s receiving free utilities in your name until you begin receiving unpaid bills.

- Other nefarious activities

Your stolen Social Security number gives access to more personal data about you. From prior living places to your credit history and medical information, your SSN says a lot.

This personal information is considered valuable to threat actors, who are, in this case, called data brokers. They sell your data on the dark web, which might later be used to initiate spam attacks, among other things.

Since this is technically a way of using your data online, there are also ways to retrieve it. And I recommend doing so with the help of Incogni — our personal information removal service.

What can you do if someone steals your SSN?

If your Social Security number gets stolen and you wish to protect yourself from possible harm, there are a few things you can do, along with the help of an identity theft protection service:

- Review your earnings on your Social Security statement and contact the SSA (Social Security Administration) if any inconsistencies occur.

- Report identity theft to the Federal Crime Commission.

- Lock your SSN via the E-Verify platform to prevent employment-related identity fraud.

- Freeze your credit with the top 3 credit bureaus.*

- If you’re experiencing any of the above-mentioned types of identity theft, report them to the responsible government organ.

*Freezing your credit will not impact your credit score. However, it will prevent you — or anyone else using your information — from applying for loans, opening bank accounts, or renting any apartments as long as the freeze is active.

Can you freeze your Social Security number?

You cannot freeze your Social Security number itself, but you can freeze your credit. However, you should only consider doing this if you’re very concerned, start receiving unfamiliar bills or credit notices, or if your bank warns you of identity theft.

Can someone access my bank account with my Social Security number?

Someone could try to access your bank account using your Social Security number, but it alone wouldn’t be enough. They’d need a lot more personal information than that to get to your finances.

Don’t believe me? Try calling your bank and saying you’ve forgotten your password. You’ll be surprised at the range of questions they’ll ask you, from “What is the second letter of your mother’s maiden name?” to “When and how big was your last deposited check?” and “Is the number you’re calling from your personal one?”

Often, you’ll be required to physically show up if you want to reset your bank account password. Why?

Anyone can call a bank having stolen someone else’s Social Security number, but it’s not enough to prove your identity. Usually, a bank would not even ask for your SSN if you called them because it is not a good way to verify who you are.

Without additional information, no one could access your bank account with your Social Security number alone. In terms of bank security, you should worry about other things like a poor password, lack of two-factor authentication, and general carelessness when online banking.

How can someone get your Social Security number?

There are several ways someone can acquire your SSN and other personal information. Mainly, you should watch out for the following:

Data leaks

One of the examples is the infamous NPD breach I mentioned at the beginning of this article. National Public Data, a background-checking company, suffered a data breach in late 2023. The stolen information, with multiple records linked to a single person, had been advertised and shared on the dark web for months before the company even confirmed the breach had happened.

But that’s far from the only massive data breach — back in 2017, Equifax leaked millions of SSNs in a single breach. With phishing on a concerning rise for a while now, personal information held in “safe” databases often ends up on the dark web, where cybercriminals trade and exploit it for personal gain.

Data leaks are by far the easiest and most common way to acquire peoples’ SSNs and other personal information.

Stolen personal belongings

Losing your bag, wallet, or mail to a crook can expose a lot of your personal information. After all, we virtually carry our lives in our pockets!

Phishing

Whether by email, text, or phone, phishing can attempt to lure your credentials and personal information out of your own hands. Educate yourself on how to avoid it!

Stolen documents

It’s also possible for someone to physically steal records or documents with your personal information from work or home. However, these instances are rather rare since most data is stored online these days.

Trash

Do not throw your documents, bank statements, or checks into the trash like they’re useless. They might seem so to you, but they contain your personal information.

How can I check if my SSN was leaked?

Data leaked during breaches usually ends up on the dark web. There are databases online that can scan the web for leaked personal information. For the most part, these include email addresses, which is not much.

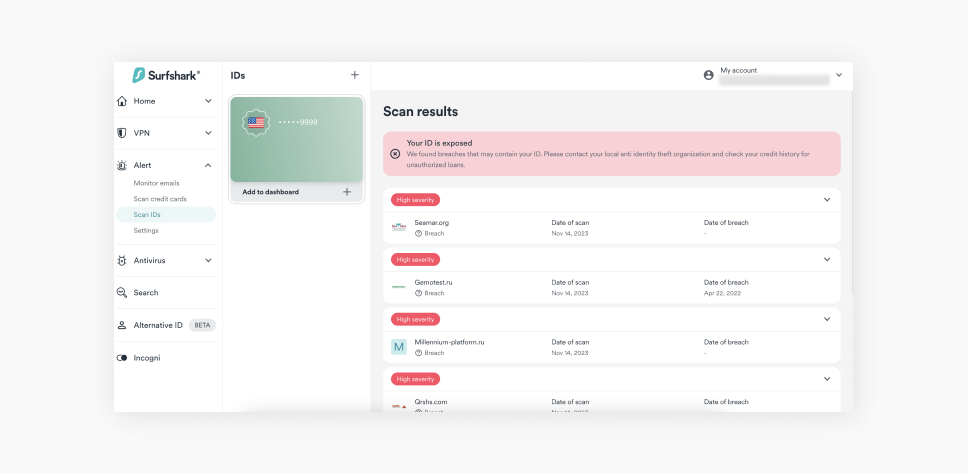

Surfshark Alert can check the web for leaks of your emails, passwords, Social Security numbers, and credit card information. It will also continue to monitor your information and will notify you if it finds that any of your data leaked on the web.

Here’s how you can check your SSN for leaks with Alert in six steps:

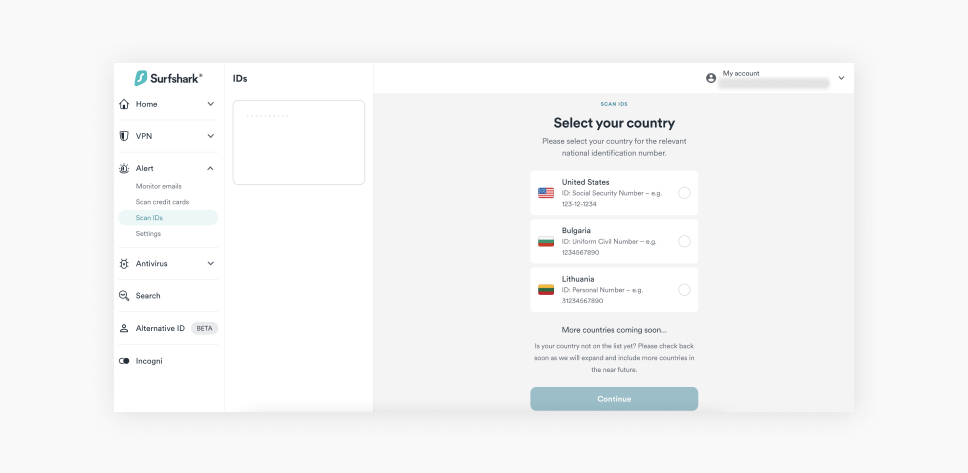

- Log in to your Surfshark account;

- On the left side of your panel, navigate to Alert and select Scan IDs;

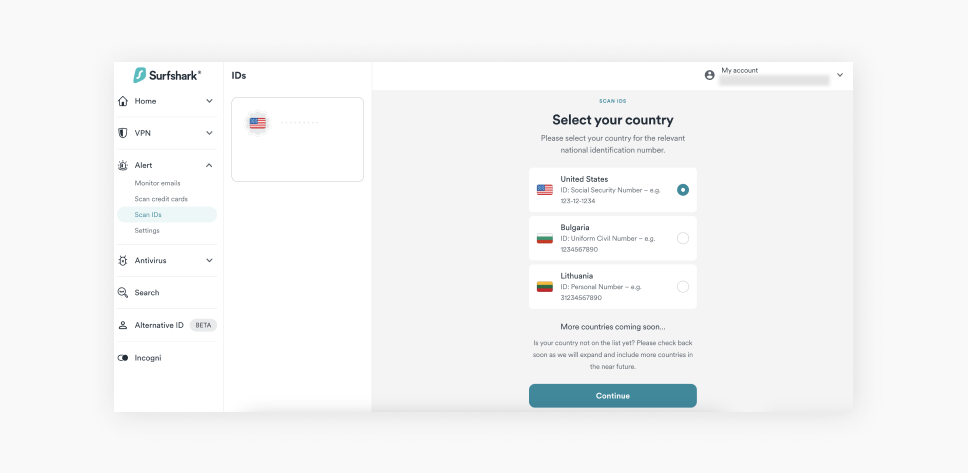

- Select the United States and click Continue;

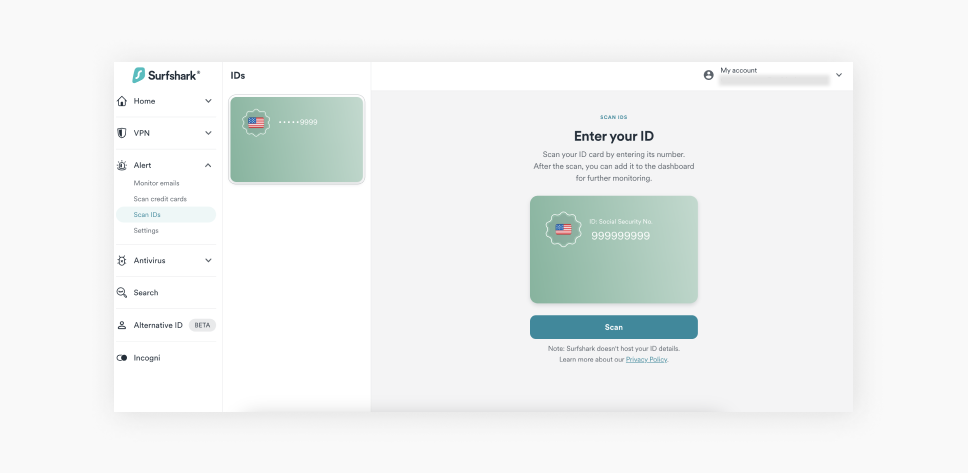

- Input your Social Security number and click Scan;

- Wait for the Scan to finish. This shouldn’t take more than a few seconds;

- Voila, your SSN is scanned. If you wish to keep it under regular monitoring, add it to your dashboard!

How can I know if someone is using my SSN?

As I mentioned before, it is not always obvious or even possible to immediately determine whether an identity thief is using your Social Security number. If you suspect that might be the case, there are a few things you can do:

- Contact the Social Security Administration and ask them to help you out with the problem.

- Regularly check your credit reports.

- Check how your SSN has been used on your my Social Security account.

- Monitor your financial, federal, and state tax accounts.

- Look out for suspicious activities such as strange mail or phone calls.

In conclusion: should you keep your SSN in a safe?

No, you shouldn’t. Instead, you should keep all your personally identifiable information (PII) as safe as possible. In today’s world, our personal information is mostly digital. Online security, cyber hygiene, and browsing habits are more important than ever.

Take some time to educate yourself on how to be safe online, and you won’t have to worry about losing your personal data or resources. Here are some suggestions: use cybersecurity products such as a VPN and Antivirus, a monitoring tool like Alert, and have the Alternative ID for online registrations — all of which you get with Surfshark One.

FAQ

Can someone access my bank account with my Social Security number?

No, because you would have to provide even more personal details to authenticate your identity, such as physical evidence of your passport, ID, driver’s license, etc.

Is it safe to give someone my SSN?

It isn’t safe and you should never give it to anyone who you don’t know or trust. Don’t provide your Social Security number to anyone that doesn’t have the right to see or have it.

How can I check to see if someone is using my Social Security number?

Contact the IRS, check your credit report, and monitor any and every account you own for irregularities.

How can scammers get my SSN?

There are many methods scammers use to get your information, including SSN. The main ones include data leaks, phishing, stolen documents, and online scams.

Do banks refund scammed money?

Your bank can refund your scammed money, but it may depend on the type of scam and how quickly you report it. However, refunds for wire transfers or payment apps may be harder to obtain.