Paying with cash is falling out of favor fast. Slow and messy, it’s a one-way ticket to Boomertown, USA.

Thankfully, Venmo has become the go-to app for quick and easy money transfers. But with great convenience comes great risk, as scammers are increasingly targeting Venmo users.

What are the top Venmo scams, and how can you protect your online transactions? Read on to defend your data, dollars, and digital footprint.

Table of contents

18 common Venmo scams

While there are all sorts of scams on Venmo, the top ones fall into three categories: suspicious messages, unsolicited payment requests, and too-good-to-be-true offers.

Suspicious messages

- Phishing scams

In a Venmo phishing scam, cybercriminals pose as customer service reps and send you an official-looking email or message requesting your Venmo login credentials or other sensitive information.

These messages can copy Venmo’s branding and link to a phony website. They usually have typos and other tell-tale signs, but you might unknowingly provide your login details to a scammer if you’re not careful. With your username and password, fraudsters can access your account and take off with any money stored there.

- Smishing

Smishing is a specific phishing scam in which attackers send fraudulent SMS messages. For instance, Venmo users may receive a text message claiming there’s an issue with their account, along with a link to resolve it. This link leads to a fake website designed to collect personal information.

Like regular phishing, one wrong move with these text scams can cause you to lose control of your account, and your password and funds can be compromised.

- Vishing phone calls

Scammers can target you on the phone as well. In vishing attacks, a person calls victims pretending to be a Venmo representative. They’ll say something about finding a problem with your account and ask for multi-factor authentication codes or additional information to clear everything up.

Unsuspecting Venmo users could give attackers access to their credit cards, financial accounts, and more. While a tad traditional, fraudulent phone calls show you don’t even have to be online to be hit with a Venmo scam.

- Calls pretending to be tech support

Tech support can be a lifesaver when your favorite device goes haywire — if you reach the right number. However, many scammers list fake tech support phone numbers on IT help desk sites, so people frequently call them instead of reaching a legitimate number.

The attacker will direct you to pay for any technical services via Venmo before offering help, which is extremely rare among actual tech companies. They’ll often even help you make a Venmo account. Once the transfer is made, the scammer takes the money and runs.

- Fake buyer scams

This old-fashioned scam specifically targets sellers. Attackers pose as buyers for a good or service and agree to purchase something from you. They’ll send you a fake payment notification that looks legitimate.

Thinking they’ve been paid, the victim ships the item — only to realize later that the payment never arrived. This type of fraud doesn’t target your bank account or financial information, but you’ll still lose any merchandise you hoped to sell.

- Identity theft

The internet is rife with identity theft, and the Venmo app is no different. Here, scammers use your personal information to create fake accounts, leaving victims to deal with the fallout of any illicit actions they take.

They’ll use Venmo to set up an account and buy or sell goods in your name. Any suspicious activity on that account — from financial theft to improper contact with others — can cause all kinds of headaches down the road.

- Stranger posing as a friend

Impersonating victims’ friends and relatives is a common tactic employed by scammers. Fraudsters can easily create a fake Venmo account that looks like it belongs to someone you know, reusing their username and profile pic.

What do they do next? They ask you to send money. Thinking it’s your friend, you transfer the funds, only to find out later — potentially much later — that you were dealing with a scammer all along.

Unsolicited payment requests

- Accidental money transfers

In these scams, criminals “accidentally” transfer money to your account and then ask you to return it. It’ll usually be a large sum, but they’ll claim it was a mistake and play on your good nature to have you send it back to an account they control.

The catch? The original transfer comes from a stolen credit card or hacked account. Venmo will find out and reverse the initial transaction, but you’ll still be on the hook for the money you sent and won’t be able to get it back. Exploiting this flaw in Venmo’s refund process lets scammers steal funds while hardly getting any blood on their hands.

- Romance scams

Romance scams involve fraudsters building a relationship with a victim online before asking for financial assistance. Talk about pulling on your heartstrings.

Also known as pig farming, these schemes often involve scammers claiming they’re facing an emergency and playing on the feelings of others to request money via Venmo. Emotionally manipulated, victims are usually more than happy to help out. The thing is, as soon as the money is sent, the attacker disappears.

- Overpayment scams

Similar to accidental money transfers, overpayment scams see schemers overpay for a certain purchase and ask for a refund of the excess amount. They pay a seller more than the agreed-upon amount and ask for the difference back.

In most cases, the victim refunds the overpayment immediately — who wouldn’t?

Well, surprise, surprise. Little do they know that the original payment was made with stolen funds. It gets reversed and removed from your account. Meanwhile, your own transfer stays, leaving you no way to get your money back.

- “Stranger in the street” scam

This scheme is more of a low-tech attack that just happens to involve a payment app like Venmo or PayPal. A scammer literally approaches you in person and claims they need help. They’ll want you to use your Venmo account for some kind of emergency and try to convince you to send money as quickly as possible.

But it’s all an act. The victim transfers money as requested, but they’ll never see it again. This attack is a bit more brazen as it requires physical contact with victims, but it remains a Venmo scam that users should be aware of.

- Paper check scam

Another old-school Venmo scam revolves around paper checks. You know, the things grandma uses to pay her water bill.

Here, a scammer sends you a physical — and fraudulent — check as payment for something you’re selling. You deposit it into your bank account, and the scammer then asks you to send part of the money back through Venmo, suggesting that it’s to cover fees, overpayment, etc.

But before the bank discovers the check is bogus, you’ve already sent the scammer the funds. Once the bank finds out, they’ll reverse the deposit and leave you a negative balance. And the scammer? They’ll be sitting pretty with the money you sent.

- Onboarding fees

Many job hunters turn to the internet to help with their search, and Venmo frauds also exploit this. In these scams, victims receive a job offer but are told to pay an upfront fee for training or equipment via Venmo before getting started.

After paying, the job offer will simply disappear as it was never legitimate in the first place. Not only are you stripped of any money you sent over the payment app, but you’re also forced to restart your job search from square one.

- Payments from strangers

In general, interacting with strangers over Venmo is risky business — especially if they randomly send you large sums of money.

A common Venmo scam involves you getting funds from a completely unknown person. Soon enough, they ask for the money back, claiming they mistakenly sent it to you.

Once you return it, though, you’ll be in for a rude awakening. Venmo will be notified that the original transfer came from a stolen credit card and will remove the balance from your account. Lo and behold, the scammer pockets the refund you sent them, leaving you high and dry.

- Pre-payment for goods and services

Prospective buyers are also at risk of encountering scammers. Online fraudsters often pose as sellers and request payment via Venmo before providing any goods or services.

The victim pays for the item upfront, but the scammer never delivers the goods. You’re left without your money and the product you had your heart set on.

Too-good-to-be-true offers

- Fake investment scams

This scam is one of the oldest in the book. A con artist contacts their victim online and offers once-in-a-lifetime investments with high returns. To strike it rich, all you have to do is send them the right amount of money over Venmo.

However, after sending the money, you’ll quickly find out that — poof — the scammer has vanished. The investments were false, and you have no way of getting your funds back.

- Fake prize or cash reward

This scam wants victims to believe they’ve won an incredible reward. Attackers will send congratulatory messages over the phone or email claiming that all a person has to do to receive the prize is provide their Venmo login details or send a small payment.

But what seems like good fortune is usually a well-orchestrated fraud. More often than not, scammers are looking to steal your personal details or credit card information, and you’ll end up empty-handed if you follow through with their requests.

- Offers to make money fast

The internet is rife with get-rich-quick schemes, and Venmo is no different. Someone will contact you promising untold riches. All you have to do is send them a small payment first.

The money is sent, the scammer disappears, and the unsuspecting victim will never see the promised returns.

How to identify Venmo scams

All three major kinds of Venmo scams can have severe consequences. Thankfully, each has its own warning signs that’ll make them easier to spot.

Suspicious messages

You can communicate with all kinds of people when you use an app like Venmo, but what makes a message genuinely suspicious?

- Emotions that create a sense of panic;

- Poor grammar and mismatched sender information;

- Shortened links or attachments with unfamiliar file types;

- Generic greetings like “Dear user” that don’t use your name;

- Requests for sensitive information, like passwords or account numbers.

The following steps will help you determine if the person contacting you is a scammer:

- Double-check the sender’s email address and phone number.

- Search for the message contents online to see if it’s a well-known scam.

- Hover over links to view the actual URL before clicking.

Unsolicited payment requests

Here are some red flags linked to sketchy requests for payment:

- Requested amounts are high or unusual;

- Payment requests use threats or urgent language;

- Requests also ask you to disclose personal information;

- Requests are unexpected and come from unfamiliar contacts;

- Requests lack detail and come from accounts with minimal transaction history.

How can you verify these requests? Follow these steps:

- Before sending any money, contact the person outside Venmo to see if everything’s on the up and up.

- Check the requestor’s profile for inconsistencies. Review past communications and recent transactions to ensure nothing’s out of place.

- Avoid clicking on any link that takes you outside the Venmo app or site, and don’t follow instructions you don’t usually get.

Too-good-to-be-true offers

Don’t fall for promises of quick cash by watching out for:

- Offers requiring upfront payment;

- Requests asking for personal information;

- Testimonials that seem overly positive or fabricated;

- Guarantees of profit without any mention of the risks;

- Claims that the opportunity is free, exclusive, or for a limited time only.

Take these steps to verify the legitimacy of any of these messages you receive:

- Request detailed documentation or evidence supporting their claims.

- Reach out to others who interacted with the offer and gather feedback.

- Investigate the person or company making the offer by searching for reviews or additional information online.

Tips to protect yourself from Venmo scams

There’s a good chance you’ll run into some kind of internet fraud at one point or another, so here are 10 simple tips to help you avoid Venmo scams and stay safe online:

-

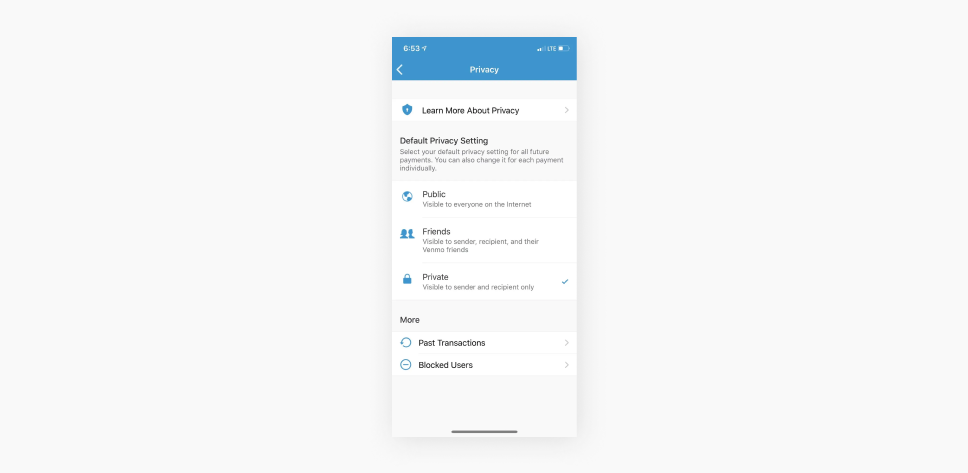

Make your payments private

Hiding your payment info reduces the risk of scammers seeing your transactions and targeting you. To go private in Venmo, follow these steps in the app:

- Go to the Me tab.

- Tap the Settings gear at the top right.

- Hit Privacy.

- From here, you can hide past transactions and adjust your privacy levels for future payments.

-

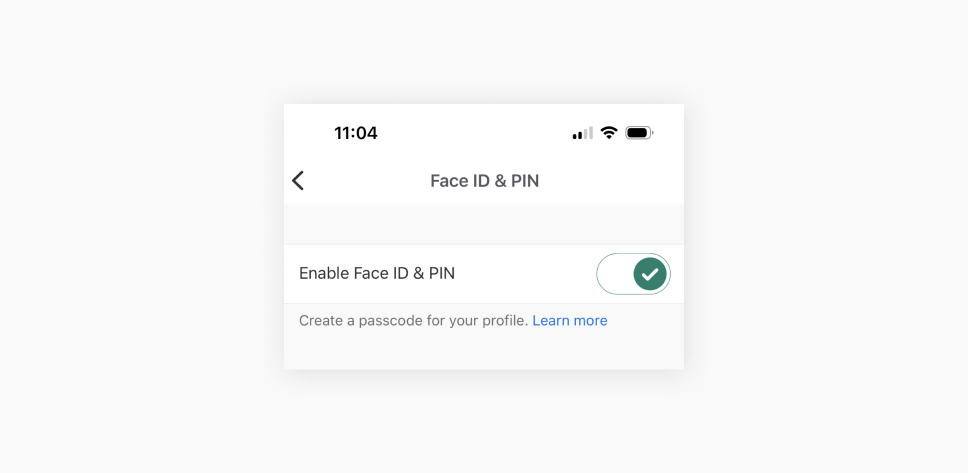

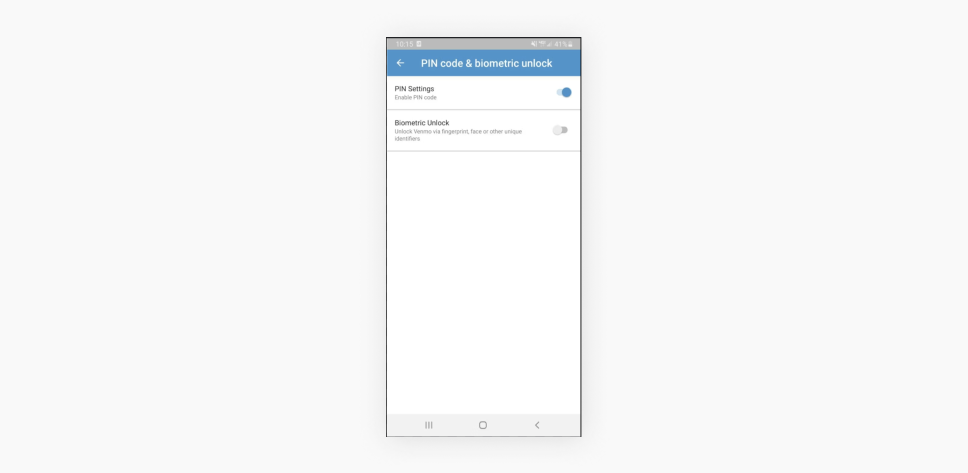

Enable security features

Venmo lets you log in securely and makes it harder for scammers to get to your account by taking these steps in your mobile Venmo app:

- Go to the Me tab.

- Tap the Settings gear at the top right.

- Hit Face ID & PIN if you have an iOS device or PIN code & biometric unlock on an Android device.

- Tap the toggle to enable the PIN feature and create your PIN.

-

Only interact with trusted people

You should only send money to people you trust or know personally. Venmo’s guidelines stress that the app is useful for settling payments between friends and encourage users to be cautious when sending money to purchase goods and services.

-

Monitor your account regularly

Routinely check your transaction history in the Venmo app to make sure no funds have left or entered your account without your knowledge. Early detection of unauthorized transactions can prevent significant financial loss.

-

Educate yourself, your friends, and your family

Discuss the risks and safe usage practices of payment apps like Venmo. Everyone in your household and social circle will be better equipped to avoid scams as a result.

-

Use strong passwords

Create a complex, unique password for your Venmo account and change it every three months or so. Strong passwords reduce the risk of unauthorized access to your account and help keep online attackers at bay.

-

Decline payments from strangers

If you see unknown transfers have made their way into your Venmo account, you don’t have to accept them. Venmo lets you decline unwanted payments if you suspect someone is trying to scam you. You can even block strangers who pay you or send requests you can’t verify.

-

Get a VPN

Use a virtual private network like Surfshark VPN to enhance online privacy, especially when using public Wi-Fi. A VPN encrypts your web traffic and masks your IP (Internet Protocol) address, making it hard for scammers to intercept your personal data.

-

Use data leak monitoring tools

Get a data leak monitoring service — like Surfshark Alert — to get notified whenever your info is leaked. Protect your debit card and see how vulnerable your passwords are by detecting if your data is compromised early on.

-

Generate a new online identity

Take advantage of tools like Surfshark’s Alternative ID to create a new online persona, including a name, email, and phone number. This masks your real information and reduces the risk of phishing, identity theft, and other scams.

What to do if you fall victim to a Venmo scam

If you’ve been targeted by a Venmo scam, here’s what you can do:

- Immediate steps: report the scam to Venmo, change your password in the app, and contact your bank and credit card company so they’re aware of the attack. The sooner you act, the better your chances of limiting any damage done;

- Further escalation: file a report with local law enforcement. Provide as much information as possible to help catch the scammers. You can even contact the FTC (Federal Trade Commission) so they’re aware of the fraud, too;

- Future prevention: implement stronger security measures to defend yourself from future attacks. This can range from installing antivirus software to staying informed about new scam tactics.

Safeguard your Venmo transactions

Venmo is a convenient tool for sending money quickly, but you must be aware of the risks involved with using any payment app. Scammers may be getting more sophisticated, but staying informed and taking simple precautions can significantly boost your online security.

Precautions like getting a VPN.

By encrypting your internet connection and hiding your IP address, a VPN makes it difficult for hackers to intercept your data and track your online activities, shielding you from fraudulent activity and other cyberthreats.

FAQ

What are common Venmo scams?

Common Venmo scams include phishing, payment reversal scams, unsolicited payments, fake prizes or cash rewards, and payments from strangers.

Can someone steal your bank info from Venmo?

Yes, a scammer can access your linked bank information if your Venmo account is compromised. However, the Venmo app itself doesn’t reveal any banking details.

Will Venmo refund me if I get scammed?

No, Venmo doesn’t typically offer refunds for payments made to scammers, so it’s important to be cautious. There’s no guarantee you’ll get your money back.

Does Venmo protect against scams?

Venmo has security measures like fraud detection in place that can limit the chances of encountering a scam. However, these steps aren’t 100% effective, so users should stay vigilant while using Venmo and other payment apps.

Is it safe to give a stranger your Venmo?

No, it isn’t safe to share your Venmo details with strangers. Interacting with unknown people on payment apps is risky and can result in falling victim to a scam or unauthorized transactions.