Ever get that split second of panic after clicking Pay while shopping online? The one where you wonder, did I just buy a sweater or hand over my life savings?

Relax — we’ve all been there. Thankfully, plenty of safe payment methods are available to ensure your transactions are secure and in good hands.

What’s the safest way to pay online? Whether you’re shopping or sending money online, the answer to protecting your financial information and identity is just around the corner.

Online payment security 101

We live in an age where online shopping has become second nature. Global e-commerce sales for 2024 crossed the $4T mark and aren’t showing signs of slowing down.

And why should they? Paying online has never been easier. You can purchase anything from groceries to gadgets with the click of a button.

However, with great convenience comes great responsibility. Shoppers lost over $35B in online payment fraud in 2024, so using secure online payments is key to protecting sensitive information, like bank account numbers, credit card details, or personal data, from various internet risks.

Sharing your financial data over the web exposes you to the following threats:

- Fraudulent transactions: third parties can make unauthorized purchases that drain your bank account;

- Hackers: malicious actors may steal your credit or debit card details while you try to complete an online payment;

- Identity theft: as more personal financial information is shared online, there’s a greater chance of your private details getting compromised;

- Data breaches: security vulnerabilities in a website or app can lead to your sensitive data getting leaked;

- Phishing scams: it’s all too easy for unsuspecting victims to divulge their login credentials — or something worse — after receiving fake emails or messages.

Online payment risks — a closer look

Internet shopping is convenient, but buyer beware — paying for things online often involves some risk of online payment fraud.

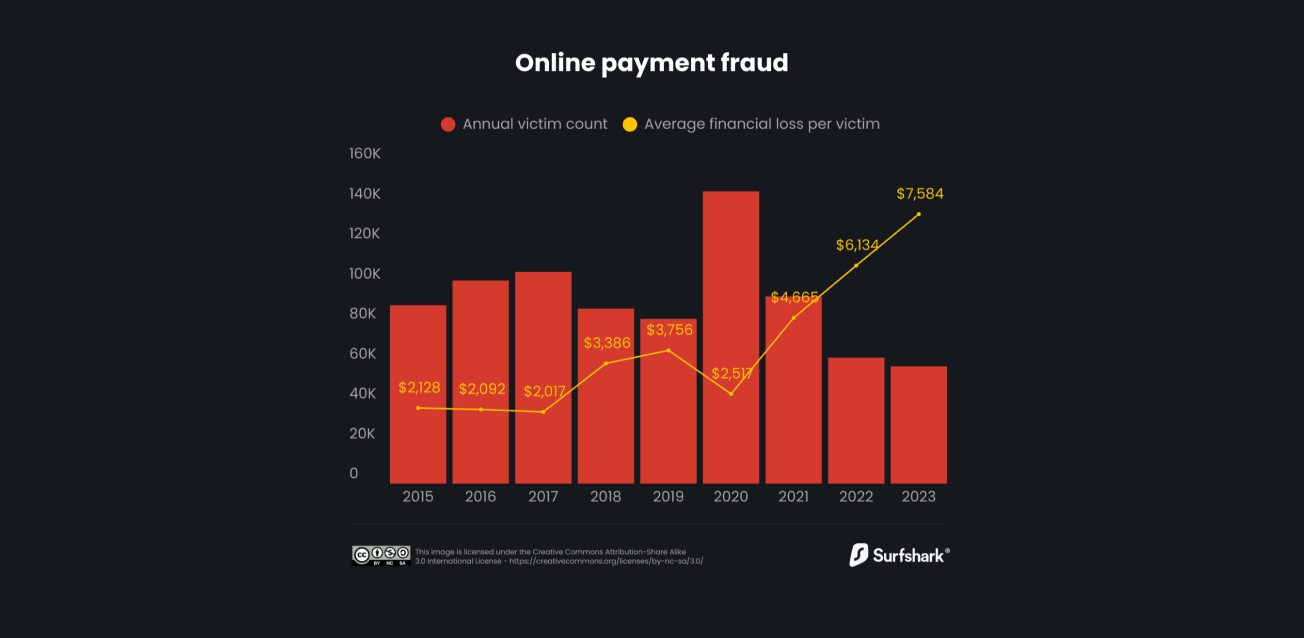

Source: Surfshark Research Hub

Research from Surfshark found that online payment fraud successfully targeted about 50,000 victims in 2023. While this annual count is relatively low, the year marked an all-time high for the financial loss per victim. In 2023, the average cost of each attack topped $7,500, representing nearly 25% growth from the year before.

As long as you’re shopping over the web, the threat of online payment fraud — however low — is always there. Understanding this risk can let you decide which secure payment methods are best for you when making purchases online.

Top 10 safest online payment methods

Now that we’ve covered why online payment security is vital, let’s explore the most secure online payment methods available — in no particular order — and their pros and cons.

1. Credit and debit cards

It should come as no surprise that credit cards are among the most commonly used methods for online payment. And with good reason — using them requires little effort.

When you buy something on the internet, you only need to enter your card details, including the card number, expiration date, and CVV (Card Verification Value) code. Your payment gateway, like PayPal, Stripe, or Square, securely handles this info to facilitate your transaction.

On top of this, major credit card issuers have fraud detection systems that let you dispute unauthorized charges. Most online shops also accept credit cards from the biggest providers, like Visa or Mastercard, allowing for more friction-free purchases.

That said, using a credit or debit card has its drawbacks. Inputting your card number online inevitably opens the door to fraudulent transactions. Overdraft fees and high interest rates can make your credit card bill your worst nightmare and cause your debt to surge, so keeping up with your credit card payments is crucial.

| Pros | Cons |

|---|---|

| Widely accepted | Risk of fraud |

| Consumer protection | Debt can quickly grow |

2. Digital wallets

Digital wallets, like Google Pay and Apple Pay, aren’t just for contactless payments. They offer another layer of convenience and security for online shopping. They act as intermediaries, letting you link bank accounts or credit cards to your smartphone without having to enter any sensitive information onto a website.

A primary benefit of a digital wallet is that you can manage multiple payment methods from one place with a lower risk of exposing personal financial data. Checkout is also completely streamlined, and your payment processor shouldn’t raise any issues.

On the other hand, some of these services charge transaction fees, especially for users looking to make instant transfers. Account limitations may also be in place, restricting how much you can send or receive at one time.

| Pros | Cons |

|---|---|

| Greater convenience and privacy | Possible fees |

| Buyer protection against fraud | Account limitations |

3. Cryptocurrencies

Cryptocurrencies like bitcoin and Ethereum have become popular digital-first payment methods among privacy-conscious consumers. When you purchase something with cryptocurrency, the transaction is processed via blockchain technology, providing increased security and transparency.

The thing with crypto is that, unlike credit cards and older payment methods, it’s not tied to any central bank or government. As a result, it’s much more resistant to things like fraud or third-party interference.

However, as an emerging tech, crypto still isn’t a widely accepted form of payment for many online shops. Crypto has also been known to be quite volatile, so any fluctuations in its value can greatly impact how much you’re able to buy.

| Pros | Cons |

|---|---|

| Decentralization lowers fraud risk | Volatile |

| Greater anonymity | Limited acceptance |

4. Bank transfers

Bank transfers may seem like a traditional way to handle online payments, but as the saying goes, if it ain’t broke, don’t fix it.

Transfers are a tried-and-true method that requires users to insert their bank account details manually. Certain platforms even offer direct bank transfers without the need for payment processors or wire transfers for international transactions. Since these transfers typically require identity verification and involve direct transactions between a user’s bank and a shop’s financial institution, they’re another secure option.

But this safety comes at a cost — speed. Bank transfers are considerably slower, and the payment process can take longer than options like debit cards. They also offer less fraud protection in some cases. If you ever need to dispute a transaction, successfully recovering your funds can be challenging once they’re transferred.

| Pros | Cons |

|---|---|

| Direct payments are possible | Slower processing times |

| No third parties involved | Less fraud protection |

5. Virtual payment cards

Virtual payment cards are temporary, disposable card numbers created by your bank or card provider specifically for online purchases. They can typically be used for a limited number of transactions or within a set period before expiring.

The top advantage of virtual payment cards is that they shield your actual card information from online merchants. Even if the virtual card details are compromised, they can’t be used for unauthorized transactions after expiration. Most of the time, users get to set their own expiration dates, too.

While this makes them a popular choice for those prioritizing security, they’re only a temporary solution by their very nature. Constantly requesting new virtual cards from your bank after your current one expires may require more effort than many shoppers are willing to put in. Just like other modern forms of payment, they aren’t universally accepted. Not all financial institutions offer them, and certain shops don’t accept virtual card payments.

| Pros | Cons |

|---|---|

| Enhanced security | Limited use and availability |

| Flexible | Only a temporary solution |

6. Mobile payment apps

Mobile payment apps like Venmo, Cash App, and Zelle are gaining popularity, especially for P2P (peer-to-peer) transactions. These apps link to your bank account or credit card, letting you transfer funds or make payments with just a few taps on your smartphone.

Mobile payments offer speed and convenience, specifically when making payments to friends, family, or small businesses. Many also incorporate additional security features, like fingerprint or facial recognition, to further secure your online transactions.

While mobile payment apps are currently in vogue, they’re still not entirely accepted by many sellers. You also depend on your smartphone to use them, which many shoppers might find restricting. If your device isn’t compatible with these apps, they’re a non-starter.

| Pros | Cons |

|---|---|

| Convenient for heavy mobile users | Users are device-dependent |

| Offer elevated security features | Not widely accepted by merchants |

7. Biometric payments

Biometric payments are an advanced form of secure online payment that authenticates a transaction using your unique physical traits — think fingerprints, facial recognition, or eye scans.

These payments are as convenient as you can imagine. There’s no need to enter card details or passwords manually. Since they rely on your physical features, they’re remarkably secure, too.

If this sounds like science fiction, you’re not far from the truth. Biometric payments generally aren’t used on their own. They’re typically only used as authentication methods for broader payment systems, like Apple Pay, to verify your identity before authorizing a transaction. The technology to shop online using a standalone biometric payment method simply isn’t there yet.

| Pros | Cons |

|---|---|

| Cutting-edge security | Privacy concerns |

| Unmatched convenience | Can only be used in conjunction with other methods — for now |

8. ACH payments

ACH (Automated Clearing House) payments are direct transfers between bank accounts that are frequently used for recurring payments like bills or direct deposits. Still, ACH can also work for one-time purchases, especially with services that support bank transfer options.

ACH payments are processed through a centralized ACH network, providing a safe, well-regulated ecosystem for financial transactions. They also have lower processing fees than traditional credit cards.

This method has two disadvantages compared to credit cards. First, it’s nowhere near as fast, often taking several days to complete. Second, ACH payments offer less fraud protection, giving you limited recourse for recovering funds once they’ve been transferred.

| Pros | Cons |

|---|---|

| Cost-effective | Longer processing time |

| Allows for direct bank transfers | Less fraud protection |

9. Prepaid cards

Prepaid cards are a unique and safe online payment method, as they don’t require a linked bank account or credit card. You simply load money onto your prepaid card in advance, and once the funds are depleted, that card is no longer usable until it’s reloaded.

Offered by most credit card companies, these cards help you keep your spending in check. Moreover, since prepaid cards aren’t linked to a bank account, you can enjoy added anonymity and security over your payments.

Prepaid cards aren’t ideal in many situations, though. Some cards are tied to activation or monthly fees, and many popular online shops don’t accept them.

| Pros | Cons |

|---|---|

| Budget control | Fees |

| No bank account needed | Limited use |

10. Gift cards

Gift cards aren’t just easy to use. In many cases, they’re also a secure payment method for online purchases.

Various online shops and third parties offer gift cards for web purchases, helping those who want to boost their online anonymity and limit the financial details they share.

Gift cards are pre-loaded with a specific amount, so the buyer can only spend the balance that’s on the card. They’re a great choice for smaller purchases and come in handy whenever you don’t want to use your primary payment method for security reasons.

But buyer beware — gift cards are usually restricted to specific shops, often have expiration dates or fees, and can’t be reloaded.

| Pros | Cons |

|---|---|

| Budget control | Limited use |

| No bank account needed | Have short-term expiration dates |

Best practices for safe online payments

Choosing the safest online payment method is ultimately up to your personal finance preferences. Whichever option you go with, you can turn to these best practices to make your online purchases more secure.

Encrypt your internet connection with a VPN

A VPN (Virtual Private Network) encrypts your internet connection and masks your IP (Internet Protocol) address, providing an added layer of security to your internet transactions.

By routing your data through a secure server, a VPN can protect your financial information from prying eyes, especially on public Wi-Fi networks. It even comes with added benefits, like helping you defeat price discrimination.

Services like Surfshark provide fast, reliable connections that enhance your online security while shopping.

Enable multi-factor authentication

Multi-factor authentication (MFA) adds an extra layer of security to your online accounts. For any transaction to go through, you’ll need to enter a second form of verification, such as a code sent to your mobile device, in addition to your password.

That way, even if someone gets their hands on your password, your accounts will stay protected from unauthorized access.

Monitor your accounts regularly

Routinely checking your bank and card statements can help you spot unauthorized transactions. To mitigate potential damage, report any suspicious activity to your bank or credit card issuer.

Be wary of public Wi-Fi

Have you ever felt a little uneasy buying something while on public Wi-Fi? That’s with good reason. Public Wi-Fi networks are usually unsecured and can expose you to security risks. Common culprits include hackers, snoops, and malware attacks.

Yes, public Wi-Fi is convenient, but watch out when using it. Better yet, always activate a VPN on public Wi-Fi to protect your data from threats lurking on the same network.

Use strong, unique passwords

Creating robust passwords that are hard to guess for all your online accounts dramatically reduces the risk of unauthorized access. Change your passwords every three months, and never use the same password across different accounts. You can also consider investing in a password manager to help you safely generate and store complex passwords.

Key takeaway: use a VPN to shop with confidence

What’s the safest way to pay online?

That really depends on many factors, but methods like credit cards, digital wallets, and mobile apps are all secure options.

Whenever you settle on a method that works for you, remember this — enabling a VPN while you shop online is the key to peace of mind and more secure payments. With an encrypted internet connection, you can enjoy greater online privacy on all your purchases.

FAQ

What is the safest method of payment online?

Some of the safest ways to pay online include debit and credit cards, digital wallets, payment apps, ACH payments, virtual cards, cryptocurrency, and more.

Is there a safe way to pay online?

Yes, options like a debit card, prepaid card, ACH payment, or digital wallet are all safe ways to pay. However, it’s important to remember that there’s always some risk involved with online transactions, so it’s essential to watch out for payment fraud and other threats.

What is the best way to pay online without a credit card?

If you want to buy something online without a physical card, you have many safe options. You can use digital wallets, like Apple Pay or Samsung Pay, but you can also use bank transfers, cryptocurrency, and mobile apps.

What is the safest way to receive money from a stranger online?

While there isn’t a single safest way to receive money online, some secure choices include PayPay or Venmo, which offer protection for both buyers and sellers. Whatever you choose, avoid sharing sensitive information with others.

What is the most secure online payment app?

Apps like Venmo, Cash App, and Zelle are all secure apps that use encryption and biometric authentication to protect customer data. They also use tokenization to shield your actual card details from merchants.